“The banks and the industry are suffering significantly – as are customers – with the amount of fraud that happens with cards and PINs. But a fingerprint can’t be forged.” – Sergio Rainero, COO, Green Bit

With banks increasingly adopting biometric technologies to protect against fraud, Green Bit is highlighting its DactyID20 solution’s applications in the financial services sector.

The company has taken its prompt from Mastercard’s recent trials of biometric payment cards, which use fingerprint sensors embedded on the cards for user authentication, instead of the traditional PIN. While Mastercard is the biggest financial services firm leading the charge in this area, a number of organizations involved in the biometrics, payments, and payment cards sectors are clearly anticipating widespread adoption of this kind of technology.

In a statement, Green Bit COO Sergio Rainero lauded the move as an important step in today’s security environment. “The banks and the industry are suffering significantly – as are customers – with the amount of fraud that happens with cards and PINs,” he said, “But a fingerprint can’t be forged.”

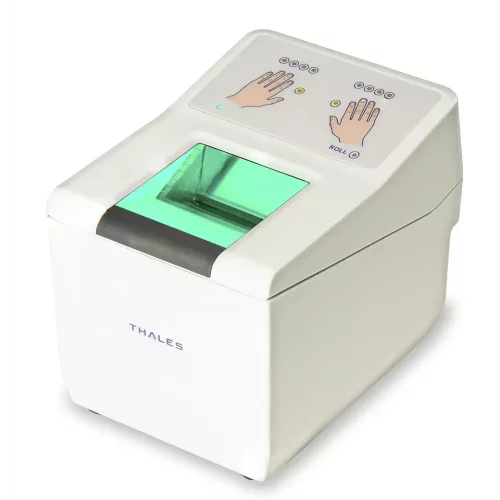

And, of course, complementary to this effort and financial services firms’ growing enthusiasm for biometrics, is Green Bit’s DactyID20, an FBI/PIV-certified fingerprint scanner featuring a built-in spoofing detection system. It’s a solution that can also be leveraged by banks in an age when PIN-based security “has run its course,” as Green Bit puts the matter.

About Green Bit

Green Bit Biometric Systems S.p.A., headquartered in Turin (Italy), designs, develops and markets a complete product line of FBI certified fingerprint scanner starting from single finger, rolled, DactyScan84c 10-print up to palm Livescan systems. Green Bit is in the market space since 1997 with a long track record of successful installations worldwide. To date Green Bit is the only 100% European Livescan manufacturer providing a full product portfolio for Value Added applications and the Law Enforcement and Civil ID market.

Green Bit addresses all markets worldwide given our direct presence with subsidiaries in the US, China and Kazakhstan in addition to an expert network of Sales Agents around the globe. Recently Green Bit launched the brand new DactyID family with fingerprint anti-spoofing software feature. The DactyID family has been designed having in mind the fast expanding market of digital transactions and added value e-services, such as: Banking, Healthcare, Commerce, etc. It is a compact single-finger FAP 20 FBI/PIV livescan, offering a built-in patented liveness finger detection system.

Related Products

Related Articles

Evolis shareholders intend to sell Evolis to HID Group, a subsidiary of Assa Abloy

20 Jul 2023 -- The co-founders and the Board of Directors of Evolis are pleased to inform you that the shareholders of edys & Co, which holds approximately 84.43% of the share capital and voting rights of Evolis (i.e. 4,407,707 shares),

HID Pursues Acquisition of Evolis to Assert Leadership in Desktop Printer Market, Expand Portfolio and Geographic Footprint

AUSTIN, Texas, July 19, 2023 – HID, the worldwide leader in trusted identity solutions, today announced it intends to acquire Evolis, a leading manufacturer of card printers and consumables. The addition of Evolis combines two of the leaders in the desktop printer market

ASSA ABLOY intends to acquire Evolis in France

2023-07-18 -- ASSA ABLOY intends to, through its subsidiary HID Global SAS (“HID”), and subject to certain customary and regulatory conditions, purchase approximately 98.5 percent of the shares of EVOLIS S.A. (“Evolis” or the “Company”), a Euronext Growth company listed

NXP Semiconductors Presents the MIFARE SAM AV3

Securing Connected Systems with NXP Semiconductors More and more of daily life has become contactless. As we navigate through our lives, people around the world use devices like smartphones, wearables and smart cards to do things like pay for purchases,

Infineon and Fingerprints step into cooperation on the all-in-one solution SECORA™ Pay Bio that will bring biometric payment cards to a new level

Munich, Germany and Gothenburg, Sweden – 24 November, 2022 – Infineon Technologies AG (FSE: IFX / OTCQX: IFNNY) and Fingerprint Cards AB (STO: FING B) today announced the signing of a joint development and commercialization agreement of a plug-and-play turnkey

What Are Security Pass Cards?

Credit Card Encryption: How Does a Security Pass Card Work? Source: https://unsplash.com/photos/bqjswIxbhEE With the introduction of the credit card back in 1966, no one could imagine that security would become such a major factor when using their cards. But

Related Products

Related Articles

SecuGen Releases Hamster Pro 30, FBI-Certified Fingerprint Reader for Mobile ID FAP 30

Santa Clara, Calif. (May 16, 2022) - SecuGen, world leader in optical fingerprint technology, is pleased to announce the immediate availability of the Hamster Pro 30 fingerprint reader and U30 OEM sensor. The new contact fingerprint reader and sensor from

Tom Hope, CardLogix: “digital identity stored in a mobile phone carries the highest risk”

We carry our IDs and credit cards with us everywhere and assume that since they aren’t completely digital, they don't need much security. But this isn’t completely true. Regular users resort to using Virtual Private Networks for guarding their

CardLogix introduce the BIOSID PRO: Mobile Biometric Enrollment / Validation / Verification tablet.

The BIOSID PRO is a biometric enrollment, validation (AFIS) and verification tablet with the capability to store and verify the enrollee information on a smart card, on the cloud, or through the device regardless of if it is connected to

Aspects’ new software functionality saves time and money for wireless test engineers

Aspects is announcing 3G and GSM Tools 5.1, the latest release of their leading suite of wireless testing tools at the 3GSM World Congress in Barcelona. These complement their market leading test tool suite and will work in conjunction with

SecuGen Leads the Pack with New Hamster Air, Touchless Fingerprint Reader

SANTA CLARA, Calif., Oct. 27, 2021 — SecuGen, world leader in optical fingerprint technology, is excited to announce the release of the new Hamster Air, the industry’s first, low cost, single finger, contactless fingerprint reader. The Hamster Air combines secure

Release of SafeSign Identity Client version 3.7 for Microsoft, MacOS and Linux

Arnhem, September 2021 -- AET Europe, the leading vendor of solutions in the area of strong digital identities, is announcing the launch of the new generation of their leading product SafeSign Identity Client, version 3.7 for Standard (MacOS and